Blog

What is Lot in Forex?

In the world of Forex the word ‘lot’ is commonly used. A forex lot represents the overall amount of a particular currency owned by a trader.

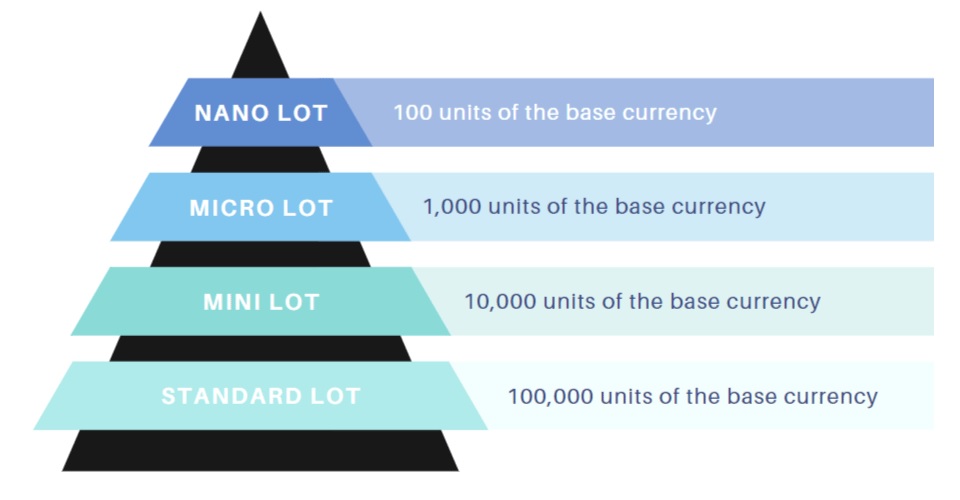

Lots are represented in various ways:

- A nano lot equals 100 units

- A micro lot refers to 1,000 units

- A mini lot is 10,000 units

- A standard lot is equal to 100,000 units

Hence, lots are essentially measuring units of trade sizes. The size of a lot has a considerable impact on the risks which one is going to face. As a general tule, a beginner trader will be better off opting for smaller lots so as to get a better understanding how trading works before moving on to bigger lots.

The most actively used type of lot is the standard lot, which as mentioned earlier is equal to 100,000 units of a currency. So, if you are trading with USD the overall amount of the standard lot will be of $100,000. Such a lot is used to open a larger position, and hence it is used by professional and experienced traders mostly. However, with the use of leverage the deposit that would be required can be reduced considerably.

The mini lot is also commonly used by traders. It represents 10,000 currency units. It is the ideal lot for those traders who would like to opt for a trade with low leverage levels, and who prefer not to risk too much. As a result mini lots are often used by both experienced as well as beginner traders.

The micro lot is the most popular option for those traders who are not well-funded. It is best for those who prefer not to deposit considerable amounts of money to start trades. This is commonly the choice of novice traders who are just starting out in the forex market.

The nano lot is the smallest lot size, with just 100 currency units. Hence in the case of USD pairs, this would be worth only $100. Nano lots are generally used only to practice forex trading, so as to develop trading strategies for upcoming bigger trades.

All in all one cannot really say which lot size should be used as this depends on various factors. The trader’s goals and preferences will play a role in such a decision, as will his financial capacity and willingness to risk a lot, or not that much. As a general rule, a beginner trader will be better off playing it safe with smaller lot sizes such as nano and micro lots. With time he can then move on to bigger lots sizes such as the mini and standard lot.

Lots are represented in various ways:

- A nano lot equals 100 units

- A micro lot refers to 1,000 units

- A mini lot is 10,000 units

- A standard lot is equal to 100,000 units

Hence, lots are essentially measuring units of trade sizes. The size of a lot has a considerable impact on the risks which one is going to face. As a general tule, a beginner trader will be better off opting for smaller lots so as to get a better understanding how trading works before moving on to bigger lots.

The most actively used type of lot is the standard lot, which as mentioned earlier is equal to 100,000 units of a currency. So, if you are trading with USD the overall amount of the standard lot will be of $100,000. Such a lot is used to open a larger position, and hence it is used by professional and experienced traders mostly. However, with the use of leverage the deposit that would be required can be reduced considerably.

The mini lot is also commonly used by traders. It represents 10,000 currency units. It is the ideal lot for those traders who would like to opt for a trade with low leverage levels, and who prefer not to risk too much. As a result mini lots are often used by both experienced as well as beginner traders.

The micro lot is the most popular option for those traders who are not well-funded. It is best for those who prefer not to deposit considerable amounts of money to start trades. This is commonly the choice of novice traders who are just starting out in the forex market.

The nano lot is the smallest lot size, with just 100 currency units. Hence in the case of USD pairs, this would be worth only $100. Nano lots are generally used only to practice forex trading, so as to develop trading strategies for upcoming bigger trades.

All in all one cannot really say which lot size should be used as this depends on various factors. The trader’s goals and preferences will play a role in such a decision, as will his financial capacity and willingness to risk a lot, or not that much. As a general rule, a beginner trader will be better off playing it safe with smaller lot sizes such as nano and micro lots. With time he can then move on to bigger lots sizes such as the mini and standard lot.