Blog

What is NDD Execution?

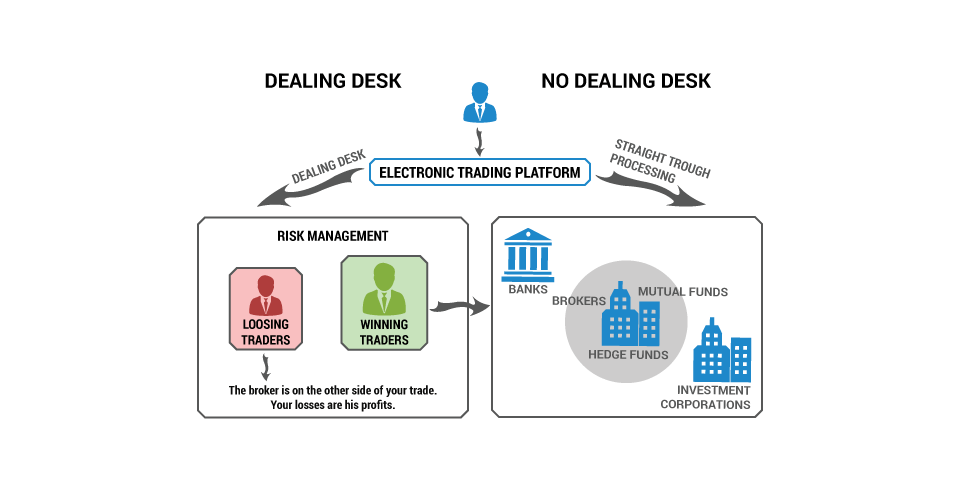

NDD stands for No Dealing Desk execution.

Hence the traders are trading directly with interbank rates and availing of the best bid and ask prices. NDD execution allows for unfiltered access to the interbank exchange rates, and traders benefit from direct access to the forex market. The orders will not have to go through the dealing desk with this kind of execution.

NDD execution can take two forms; the STP and the ECN. With both types of execution the traders have direct access to the liquidity providers. In the case of STP though the clients are also able to trade directly with each other as well. So with an ECN NDD model, there could be another trader involved. But with an STP, the other end will only be represented by a forex trading company such as a broker or a bank.

NDDs help to build better and faster connections between the liquidity providers and traders. This is an advantage of not having to go through the dealing desk, and in fact such execution is greatly preferred. Transactions are carried out more quickly, and traders will also be able to benefit from the possibility of getting the best bid/ask prices on the market.

Hence the traders are trading directly with interbank rates and availing of the best bid and ask prices. NDD execution allows for unfiltered access to the interbank exchange rates, and traders benefit from direct access to the forex market. The orders will not have to go through the dealing desk with this kind of execution.

NDD execution can take two forms; the STP and the ECN. With both types of execution the traders have direct access to the liquidity providers. In the case of STP though the clients are also able to trade directly with each other as well. So with an ECN NDD model, there could be another trader involved. But with an STP, the other end will only be represented by a forex trading company such as a broker or a bank.

NDDs help to build better and faster connections between the liquidity providers and traders. This is an advantage of not having to go through the dealing desk, and in fact such execution is greatly preferred. Transactions are carried out more quickly, and traders will also be able to benefit from the possibility of getting the best bid/ask prices on the market.