Blog

What is STP Execution?

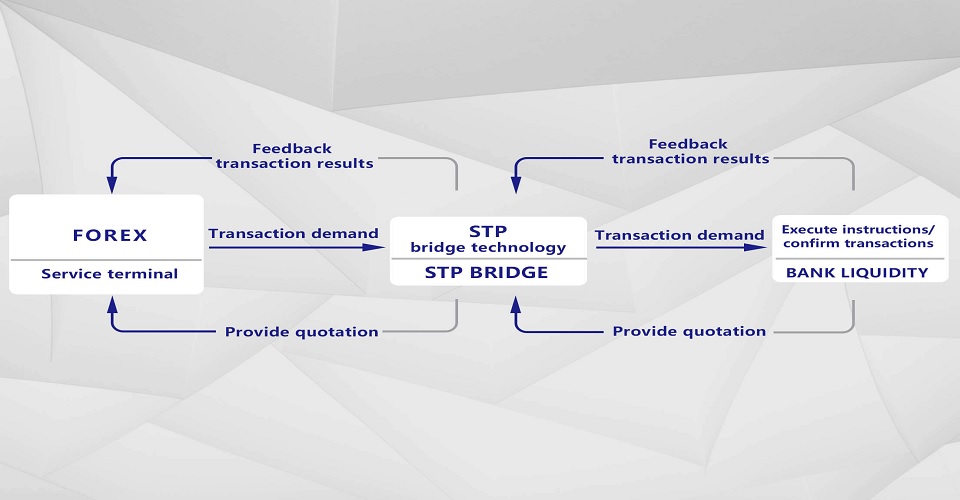

STP market execution is short for Straight Through Processing. This means that the traders’ money is sent directly to the market, so that there is a direct connection with the liquidity providers. The money thus does not pass through the dealing desk.

The STP model is very popular, and while it is quite similar to ECN, there are many who prefer it. In ECN the positions are also sent directly to liquidity providers, but with STP there is even more transparency and it is more of a hybrid option. All orders that are made with STP execution go to the liquidity providers and they do not pass through the dealing desk.

With STP execution the commissions tend to be lower than the commissions associated with ECN. Another important benefit of STP execution is the fact that everything is automated. Since there is no need for manual intervention at any point, and since there are no intermediaries involved, the transaction’s processing time is reduced significantly. Hence transactions processing time is very short.

A commonly asked question is whether STP is better than ECN. As noted earlier they have certain similarities, such as the fact that they both operate as a no dealing desk. However STP is better when it comes to the fact that the trades are forwarded directly to the liquidity providers, whereas in ECN trades there may be some inner liquidity involved between the member of the particular network.

The STP model is very popular, and while it is quite similar to ECN, there are many who prefer it. In ECN the positions are also sent directly to liquidity providers, but with STP there is even more transparency and it is more of a hybrid option. All orders that are made with STP execution go to the liquidity providers and they do not pass through the dealing desk.

With STP execution the commissions tend to be lower than the commissions associated with ECN. Another important benefit of STP execution is the fact that everything is automated. Since there is no need for manual intervention at any point, and since there are no intermediaries involved, the transaction’s processing time is reduced significantly. Hence transactions processing time is very short.

A commonly asked question is whether STP is better than ECN. As noted earlier they have certain similarities, such as the fact that they both operate as a no dealing desk. However STP is better when it comes to the fact that the trades are forwarded directly to the liquidity providers, whereas in ECN trades there may be some inner liquidity involved between the member of the particular network.