Blog

What is ECN Execution?

ECN allows trading of financial products to take place outside the traditional exchanges. As a result ECN is key in facilitating trading even outside the regular trading hours, as well as since investors and traders from various regions can trade with direct access to financial markets.

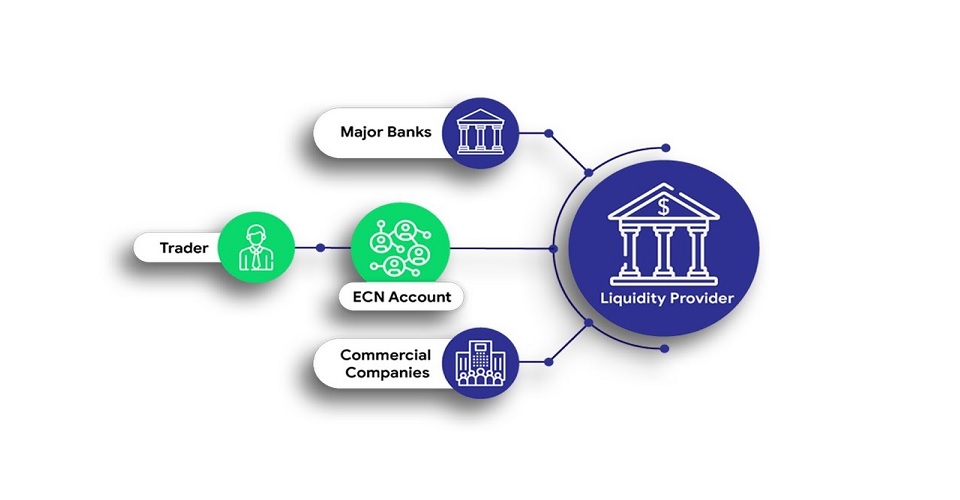

ECN is short for electronic communication network. In fact it is really all about connecting individual investors and brokers in a direct way, without the need for any third party. The ECN execution allows for the best bid and ask quotes to be displayed, and as a result the system is able to match and execute orders automatically.

ECN brokers offer traders direct access to the financial markets, and even though they charge them a commission, this is practically negligible as the spreads tend to be considerably narrower when compared to those of traditional brokers. In most cases ECN brokers are non-dealing desk brokers. Hence the orders will not be passed to the market makers since the investors will be matches in a trade and then the orders will be moved on the liquidity providers.

ECN execution is also great in that it does not only speeds up trading but also provides traders with a high level of privacy. It is also a very flexible system. Hence there are various advantages to ECN.

Besides the ECN brokers there are also the STP brokers (straight through processing brokers). These are also no dealing desk brokers, but the STP orders are forwarded to liquidity providers immediately. Liquidity providers can be brokers or global banks, who can buy or sell orders through the server.

An ECN account is known to be the best option for traders as good trading conditions are made available through it and order execution takes place rapidly and safely.

ECN is short for electronic communication network. In fact it is really all about connecting individual investors and brokers in a direct way, without the need for any third party. The ECN execution allows for the best bid and ask quotes to be displayed, and as a result the system is able to match and execute orders automatically.

ECN brokers offer traders direct access to the financial markets, and even though they charge them a commission, this is practically negligible as the spreads tend to be considerably narrower when compared to those of traditional brokers. In most cases ECN brokers are non-dealing desk brokers. Hence the orders will not be passed to the market makers since the investors will be matches in a trade and then the orders will be moved on the liquidity providers.

ECN execution is also great in that it does not only speeds up trading but also provides traders with a high level of privacy. It is also a very flexible system. Hence there are various advantages to ECN.

Besides the ECN brokers there are also the STP brokers (straight through processing brokers). These are also no dealing desk brokers, but the STP orders are forwarded to liquidity providers immediately. Liquidity providers can be brokers or global banks, who can buy or sell orders through the server.

An ECN account is known to be the best option for traders as good trading conditions are made available through it and order execution takes place rapidly and safely.