Blog

What is Carry Trade?

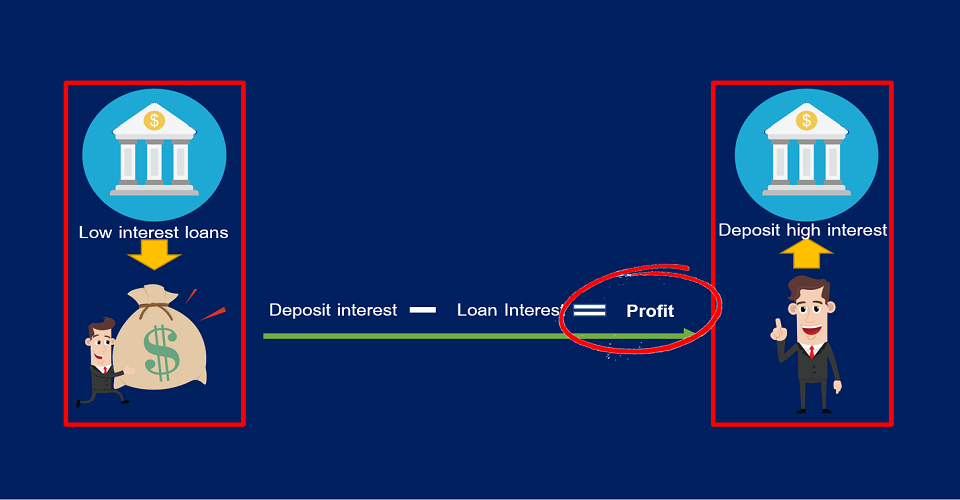

Carry trade refers to the selling or borrowing of an asset, at a low interest rate. The main aim is to use the proceeds so as to be able to fund the purchase of another asset which comes at a higher interest rate. This is one of the most popular investments in financial markets as it is rather easy to make a profit through a carry trade.

Currency carry trading refers to when a trader borrows one currency and then uses it to buy another currency. The trader pays a low interest rate on the currency he borrows and then collects a higher interest rate on the currency he buys. Many traders opt for currency pairs like the NZD/JPY and the AUD/JPY as there are generally high interest rate spreads.

There are various advantages to carry trading. While trading gains are involved, the trader also receives interest earnings. Traders also often use leverage when trading assets and so they are able to afford assets which they would not otherwise have afforded. In return huge profits can be made, even though the outlay was not that large.

Having said that, it is important to note that carry trading comes with its risks. First of all there is always a certain level of uncertainty when it comes to exchange rates. And in case leverage is used, even small changes in exchange rates can lead to considerable losses. Hence hedging is of utmost importance.

As such, risk management is very important for carry trading. For carry trading, volatile currency pairs are generally chosen. The market sentiment needs to be considered as it can have a huge impact on carry pair currencies. Thus it is important that a trader who engages in carry trading has a sound risk management strategy to back up his trading.

Carry trading can seem enticing, but it is important to be careful. In most carry trade situations, the currency which offers the highest yield also appreciates versus the currency that offers the lower yield. Hence a trader can collect a yield differential as well as a return from the appreciation of the higher yielding currency. In the long run, carry trading can be a very profitable option, but it needs to be carefully managed.

Currency carry trading refers to when a trader borrows one currency and then uses it to buy another currency. The trader pays a low interest rate on the currency he borrows and then collects a higher interest rate on the currency he buys. Many traders opt for currency pairs like the NZD/JPY and the AUD/JPY as there are generally high interest rate spreads.

There are various advantages to carry trading. While trading gains are involved, the trader also receives interest earnings. Traders also often use leverage when trading assets and so they are able to afford assets which they would not otherwise have afforded. In return huge profits can be made, even though the outlay was not that large.

Having said that, it is important to note that carry trading comes with its risks. First of all there is always a certain level of uncertainty when it comes to exchange rates. And in case leverage is used, even small changes in exchange rates can lead to considerable losses. Hence hedging is of utmost importance.

As such, risk management is very important for carry trading. For carry trading, volatile currency pairs are generally chosen. The market sentiment needs to be considered as it can have a huge impact on carry pair currencies. Thus it is important that a trader who engages in carry trading has a sound risk management strategy to back up his trading.

Carry trading can seem enticing, but it is important to be careful. In most carry trade situations, the currency which offers the highest yield also appreciates versus the currency that offers the lower yield. Hence a trader can collect a yield differential as well as a return from the appreciation of the higher yielding currency. In the long run, carry trading can be a very profitable option, but it needs to be carefully managed.