Blog

What is Forex Arbitrage?

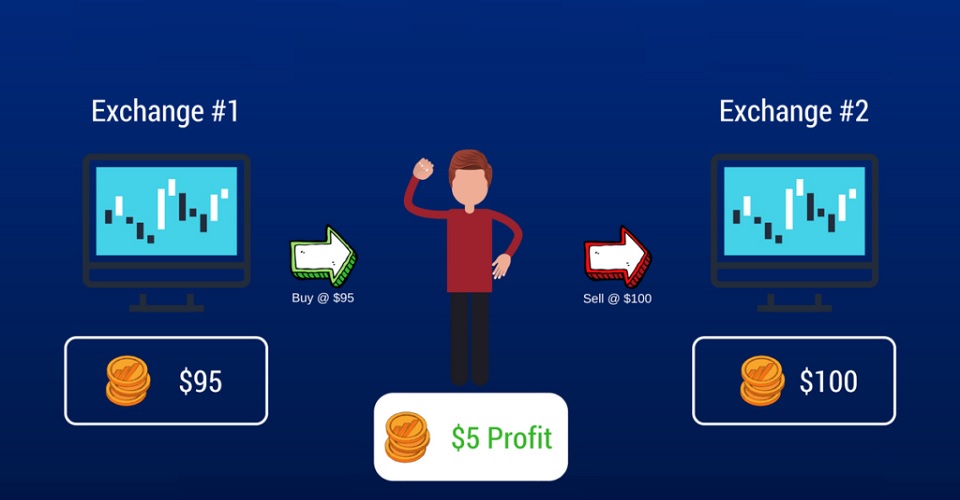

Arbitrage is defined as purchasing and selling similar assets, but in different markets, concurrently. The main aim is to make the most of price differentials. The idea is to buy the cheaper asset, and subsequently sell it at a higher price in another market. Hence a profit is made without any net cash flow.

Currency arbitrage occurs when traders utilise price discrepancies in the markets in order to make a profit. Interest rate arbitrage is a popular method, as one currency is sold from a country where there are low interest rates, and concurrently, the trader buys another currency which pays higher interest rates.

The net difference between the interest rates is referred as trading profit. This method is commonly referred to as carry trade.

Another method of currency arbitrage is the cash and carry, whereby the trader takes positions on the same assets simultaneously, in the spot market and in the futures market.

There are different types of arbitrage, such as:

- When a trader implements statistical arbitrage, the idea is to exploit relative price movements of several financial instruments in different markets by carrying out technical analysis. The goal is to ultimately generate higher profits. This is a strategy which is commonly used for medium frequency trading. Typically, a trader will open a long and a short position at the same time, so as to take advantage of the inefficient pricing of assets which are correlated.

- Triangular arbitrage is a strategy whereby three or more currencies get traded simultaneously. This helps to increase the odds that the market inefficiencies will ultimately result in profit making opportunities. In this case the trader will attempt to find situations where there is a currency that is overvalued in relation to another currency, and at the same time it is also undervalued in relation to a third currency. Thus the reference to a triangle.

- Risk arbitrage is when one buys stocks of companies which are involved in a merger or acquisition.

- Convertible arbitrage refers to a situation where one buys a convertible security and then shorts the underlying stock.

If as a trader you never tried out arbitrage you may still be unsure whether it is good or not. The answer is that it is neither a good nor a bas idea, as at the end of the day it depends on the situation as well as on how the trader acts.

Arbitrage helps to maintain some efficiency in the market, but at the same time the fact that it allows one to take advantage of situations which could arise by mistake, makes it seem rather bad.

Currency arbitrage occurs when traders utilise price discrepancies in the markets in order to make a profit. Interest rate arbitrage is a popular method, as one currency is sold from a country where there are low interest rates, and concurrently, the trader buys another currency which pays higher interest rates.

The net difference between the interest rates is referred as trading profit. This method is commonly referred to as carry trade.

Another method of currency arbitrage is the cash and carry, whereby the trader takes positions on the same assets simultaneously, in the spot market and in the futures market.

There are different types of arbitrage, such as:

- When a trader implements statistical arbitrage, the idea is to exploit relative price movements of several financial instruments in different markets by carrying out technical analysis. The goal is to ultimately generate higher profits. This is a strategy which is commonly used for medium frequency trading. Typically, a trader will open a long and a short position at the same time, so as to take advantage of the inefficient pricing of assets which are correlated.

- Triangular arbitrage is a strategy whereby three or more currencies get traded simultaneously. This helps to increase the odds that the market inefficiencies will ultimately result in profit making opportunities. In this case the trader will attempt to find situations where there is a currency that is overvalued in relation to another currency, and at the same time it is also undervalued in relation to a third currency. Thus the reference to a triangle.

- Risk arbitrage is when one buys stocks of companies which are involved in a merger or acquisition.

- Convertible arbitrage refers to a situation where one buys a convertible security and then shorts the underlying stock.

If as a trader you never tried out arbitrage you may still be unsure whether it is good or not. The answer is that it is neither a good nor a bas idea, as at the end of the day it depends on the situation as well as on how the trader acts.

Arbitrage helps to maintain some efficiency in the market, but at the same time the fact that it allows one to take advantage of situations which could arise by mistake, makes it seem rather bad.