Blog

What is a Bond?

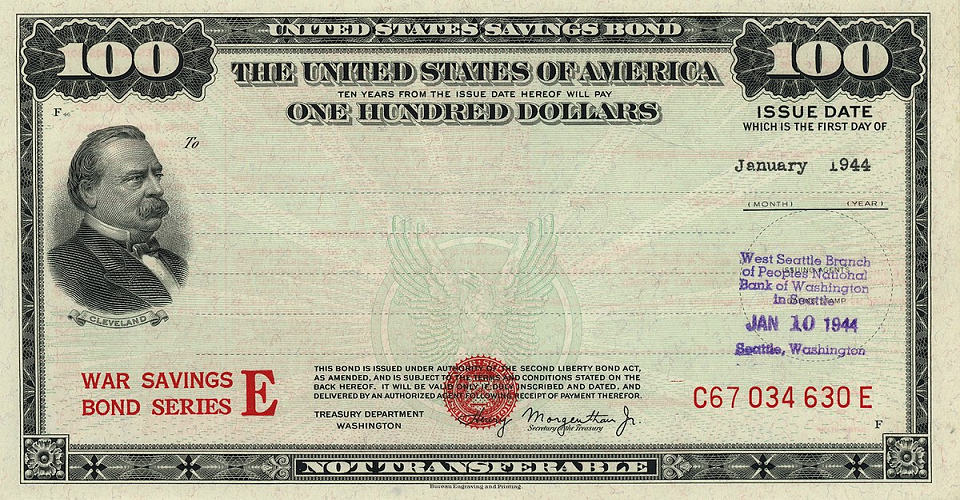

A bond is a unit of debt, which is issued by the government or a major corporation. Bonds ca n be traded on exchanges, and they are often favoured by investors, due to their low risk, and especially to use them as a guarantee on capital protection.

It is important to have a good idea how bonds work though before you decide to invest in them. There are also certain terms which you should be aware of.

First of all there are different parties involved, namely the issuer who issues the bond, and the bondholder, that is the investor who buys the bond. The bondholder will receive what is referred to as the coupon which is the interest paid to him or her. The bond will be fully paid by the maturity date. A common term used in the field of bonds is the par value, which refers to the amount on which the interest gets paid. In case the bond trades at a higher price than this par value, it is referred as the premium. On the other hand if it trades at a lower price than the par value, it is termed as discount.

Investors like to consider the yield, which is basically the coupon divided by the bond price. When buying a bond the investor pays the bid. On the other hand when selling the bond, the investor sells it for the ask price. The difference between the two, that is, between the bid and ask prices, is termed the spread.

Whenever one invests directly in the bond market, the full down value is paid and then the bondholder will wait for the interest payouts to be paid generally semi-annually. Bonds are low risk, low reward options as one trades for the long term, always expecting that the bond price and the yield will rise over time. In the case of the CFD market the bonds will be traded by speculating on their price changes in the short and medium term though. Having said that, in most cases bond prices tend to change marginally. However in the CFD market, the leverage that is available will allow for more profits.

It is important to clarify why and how bond prices fluctuate. Essentially when one buys a bond he would be issuing a loan to the government, or the corporation in question. This ‘loan’ pays at a fixed interest, however the yield fluctuates according to the price of the bond. As explained earlier this can be at par, at a premium or at a discount. Besides the forces of demand and supply, bond prices can also be influenced by the credit quality of the particular issuer as well as the term till maturity. Generally an issuer who has a high credit quality will be able to offer a lower coupon, and the bond price will often be at a premium during its lifetime. Bonds which are closer to maturity are much less likely to be affected by changes in central bank interest rates. In fact bonds usually have what is called an inverse relationship to changes in interest rates.

When trading bonds there are two main approaches: fundamental and technical. The former focus on qualifying the best bonds for the medium to long term. This leads to a passive buy-to-hold strategy that some investors prefer. Having said that there is a liquidity problem in such a case. It is important to consider certain macroeconomic aspects such as the GDP, and the unemployment rate.

Another common strategy is to trade interest rates. As bonds have an inverse relationship to interest rates, a trader can consider taking short or medium term directional plays whenever the monetary policy of the central bank is communicated. Many investors also use the yield curve play in order to have a better idea of the relationship between the interest rates and the yields at different maturity periods.

It is important to have a good idea how bonds work though before you decide to invest in them. There are also certain terms which you should be aware of.

First of all there are different parties involved, namely the issuer who issues the bond, and the bondholder, that is the investor who buys the bond. The bondholder will receive what is referred to as the coupon which is the interest paid to him or her. The bond will be fully paid by the maturity date. A common term used in the field of bonds is the par value, which refers to the amount on which the interest gets paid. In case the bond trades at a higher price than this par value, it is referred as the premium. On the other hand if it trades at a lower price than the par value, it is termed as discount.

Investors like to consider the yield, which is basically the coupon divided by the bond price. When buying a bond the investor pays the bid. On the other hand when selling the bond, the investor sells it for the ask price. The difference between the two, that is, between the bid and ask prices, is termed the spread.

Whenever one invests directly in the bond market, the full down value is paid and then the bondholder will wait for the interest payouts to be paid generally semi-annually. Bonds are low risk, low reward options as one trades for the long term, always expecting that the bond price and the yield will rise over time. In the case of the CFD market the bonds will be traded by speculating on their price changes in the short and medium term though. Having said that, in most cases bond prices tend to change marginally. However in the CFD market, the leverage that is available will allow for more profits.

It is important to clarify why and how bond prices fluctuate. Essentially when one buys a bond he would be issuing a loan to the government, or the corporation in question. This ‘loan’ pays at a fixed interest, however the yield fluctuates according to the price of the bond. As explained earlier this can be at par, at a premium or at a discount. Besides the forces of demand and supply, bond prices can also be influenced by the credit quality of the particular issuer as well as the term till maturity. Generally an issuer who has a high credit quality will be able to offer a lower coupon, and the bond price will often be at a premium during its lifetime. Bonds which are closer to maturity are much less likely to be affected by changes in central bank interest rates. In fact bonds usually have what is called an inverse relationship to changes in interest rates.

When trading bonds there are two main approaches: fundamental and technical. The former focus on qualifying the best bonds for the medium to long term. This leads to a passive buy-to-hold strategy that some investors prefer. Having said that there is a liquidity problem in such a case. It is important to consider certain macroeconomic aspects such as the GDP, and the unemployment rate.

Another common strategy is to trade interest rates. As bonds have an inverse relationship to interest rates, a trader can consider taking short or medium term directional plays whenever the monetary policy of the central bank is communicated. Many investors also use the yield curve play in order to have a better idea of the relationship between the interest rates and the yields at different maturity periods.